Excitement About Hsmb Advisory Llc

The 5-Second Trick For Hsmb Advisory Llc

Table of ContentsHsmb Advisory Llc for BeginnersExcitement About Hsmb Advisory LlcThe Ultimate Guide To Hsmb Advisory LlcHow Hsmb Advisory Llc can Save You Time, Stress, and Money.

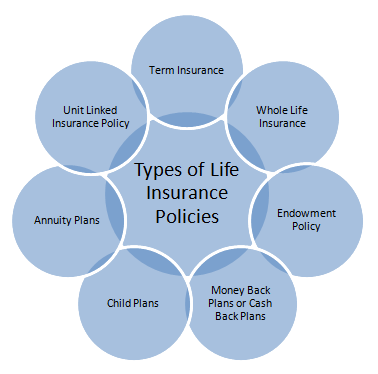

Life insurance is especially vital if your household is reliant on your income. Market professionals recommend a plan that pays out 10 times your yearly income. These might consist of home loan repayments, outstanding car loans, credit rating card financial debt, tax obligations, child care, and future college prices.Bureau of Labor Data, both spouses worked and brought in revenue in 48. 9% of married-couple family members in 2022. This is up from 46. 8% in 2021. They would be most likely to experience monetary hardship as an outcome of one of their wage income earners' deaths. Medical insurance can be gotten via your company, the government medical insurance industry, or personal insurance you buy for on your own and your family by getting in touch with health insurance policy companies straight or going with a health insurance coverage agent.

2% of the American population lacked insurance coverage in 2021, the Centers for Condition Control (CDC) reported in its National Center for Health And Wellness Data. Greater than 60% got their insurance coverage via an employer or in the personal insurance policy market while the rest were covered by government-subsidized programs including Medicare and Medicaid, professionals' advantages programs, and the government marketplace developed under the Affordable Treatment Act.

The 4-Minute Rule for Hsmb Advisory Llc

If your earnings is low, you may be one of the 80 million Americans that are qualified for Medicaid.

According to the Social Safety and security Management, one in four workers entering the labor force will come to be handicapped before they get to the age of retired life. While wellness insurance coverage pays for a hospital stay and medical costs, you are typically burdened with all of the costs that your income had covered.

This would be the very best alternative for protecting affordable handicap protection. If your employer does not supply long-lasting insurance coverage, here are some points to think about before buying insurance on your very own: A policy that guarantees revenue replacement is ideal. Several policies pay 40% to 70% of your income. The cost of special needs insurance coverage is based on numerous variables, including age, way of living, and health.

Prior to you buy, check out the small print. Lots of strategies require a three-month waiting period prior to the coverage begins, provide a maximum of 3 years' well worth of protection, and have substantial policy exemptions. Regardless of years of improvements in automobile safety, an estimated 31,785 individuals passed away in website traffic accidents on united state

Hsmb Advisory Llc Can Be Fun For Anyone

Comprehensive insurance policy covers theft and damages to your car because of floodings, hail, fire, criminal damage, check over here falling objects, and pet strikes. When you fund your vehicle or rent a car, this kind of insurance is mandatory. Uninsured/underinsured vehicle driver () coverage: If a without insurance or underinsured chauffeur strikes your car, this protection pays for you and your traveler's clinical costs and may likewise make up lost earnings or make up for pain and suffering.

Company protection is typically the most effective option, yet if that is unavailable, obtain quotes from numerous service providers as several give discounts if you buy more than one kind of insurance coverage. (https://www.openlearning.com/u/hunterblack-s9g95s/)

6 Easy Facts About Hsmb Advisory Llc Explained

Between medical insurance, life insurance coverage, handicap, obligation, lasting, and also laptop insurance, the task of covering yourselfand considering the unlimited possibilities of what can happen in lifecan feel frustrating. Once you recognize the principles and make certain you're properly covered, insurance can increase economic confidence and well-being. Right here are one of the most crucial kinds of insurance policy you require and what they do, plus a couple suggestions to stay clear of overinsuring.

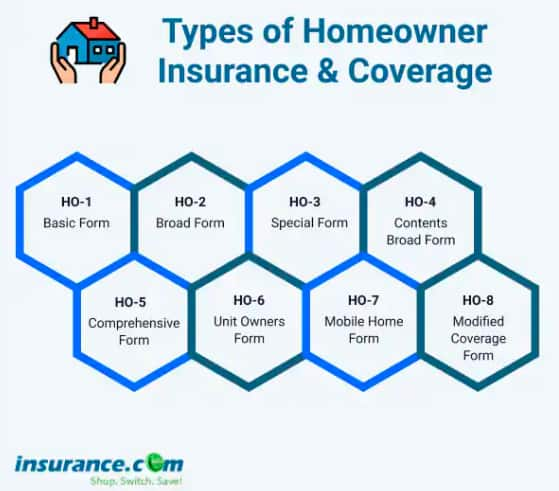

Various states have various policies, but you can anticipate medical insurance (which lots of people make it through their company), automobile insurance (if you possess or drive a car), and home owners insurance policy (if you have property) to be on the list (https://gravatar.com/hunterblack33701). Obligatory sorts of insurance coverage can alter, so check out the most recent laws every now and then, especially before you restore your plans